Account Beneficiaries, why have them?

An account beneficiary is a natural person(s) or other legal entity(ies) who receives the account funds upon death. Otherwise known as P.O.D. Beneficiary (Payable on Death).

When a deposit account is opened, it will exist after a person is deceased. The individual that opens the account will be asked to designate a beneficiary or beneficiaries. This designation is included as part of the process of opening a deposit account.

A beneficiary designation usually supersedes the instructions in a will. The will only applies to assets that do not have a named beneficiary.

When to Review Beneficiary Designations

Beneficiary designations should be reviewed annually and after major life events such as:

• Marriage

• Divorce

• Birth of a child

• Death of a spouse, partner, or a beneficiary that is already designated.

Who needs an account beneficiary?

Any deposit account owner with existing funds.

Is there an age requirement for account beneficiaries?

No, there is not an age requirement for account beneficiaries. Children under the age of 18 can be named as an account beneficiary or as a contingent beneficiary. However, if they are still a minor when the account owner dies, the account funds may be sent in their name to a legal guardian of the minor child’s estate.

Why is an account beneficiary needed?

Clarity: By assigning a beneficiary, the account owner makes it clear who should receive the deposit accounts funds in the event of their death. This will eliminate any questions or disputes among living family members and/or friends who may argue about who should have received the account funds.

Accelerate the process: Choosing a beneficiary accelerates the process of distributing deposit account funds after the account owner’s death. This will make it easier for the account beneficiary or beneficiaries to claim the deposit account funds and avoid waiting for a probate process to be completed. A named beneficiary can claim deposit account funds shortly after the death of the account owner is documented. To provide documentation of the account owner, they will need a death certificate.

Where can a deposit account beneficiary be added or updated?

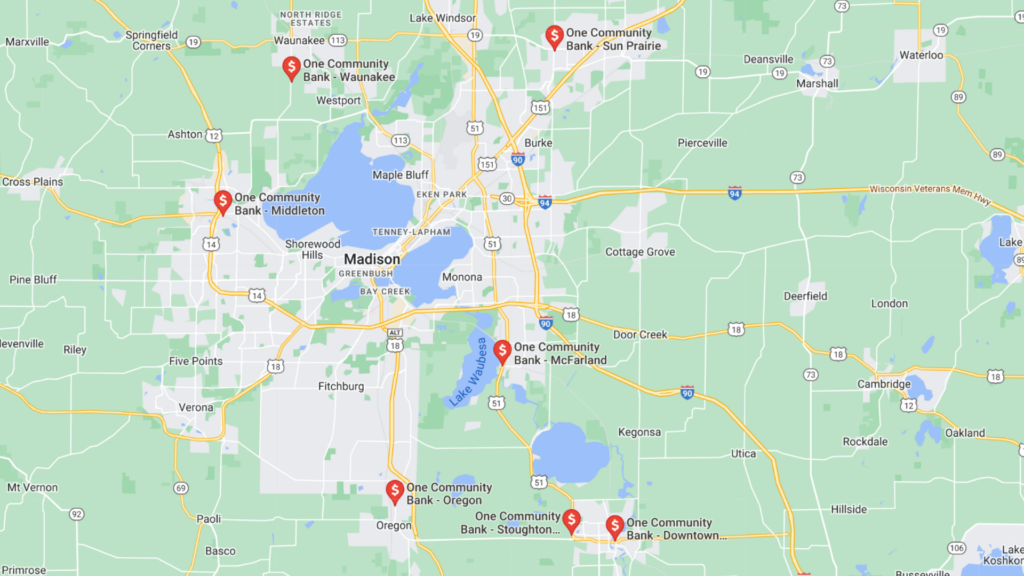

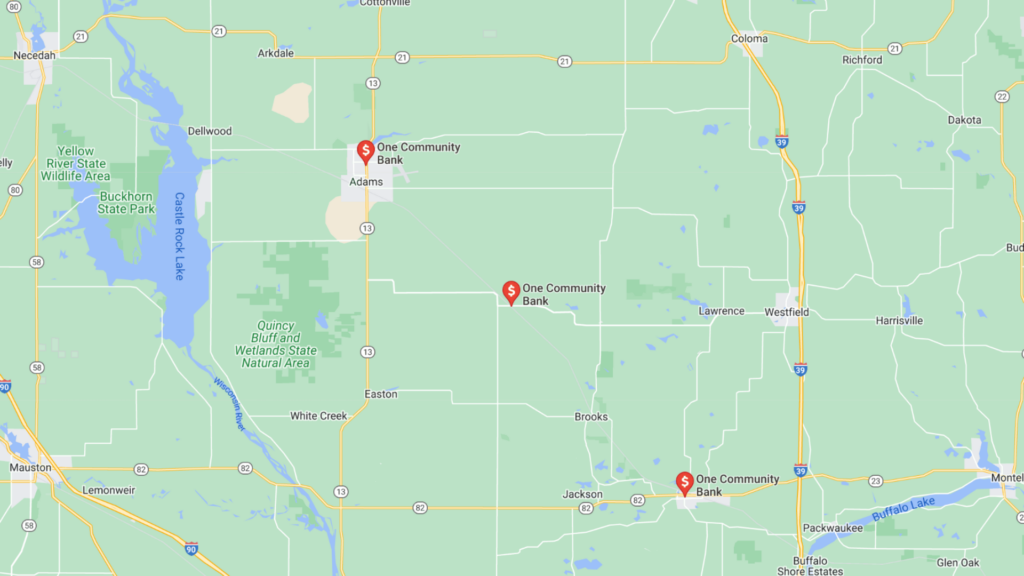

To add a deposit account beneficiary at One Community Bank, stop into any one of our One Community Bank locations and ask to have an account review meeting with a Relationship Banker.

View our locations here: https://www.onecommunity.bank/about-us/communities-served/

How is an account beneficiary added?

When a deposit account is opened, a relationship banker will ask the account owner to name at least one account beneficiary. They will add that person(s) using that person’s personal information.

After the account is opened, a meeting can be scheduled with a Relationship Banker to review any deposit accounts. During this meeting, they will review all of the deposit accounts and determine who the beneficiaries are at the time of the meeting. Account beneficiaries can be added or removed during this time.

How do the deposit account funds get distributed?

At One Community Bank, beneficiary or beneficiaries will be invited to come into any one of our locations to speak with Relationship Banker. The beneficiary will be required to have proper identification and a certified death certificate of the deposit account holder before coming in.

Identification Options:

• A valid photo driver license

• A valid U.S passport

• Photo Identification card issued by Wisconsin or another jurisdiction.

*Proof of residency if address does not match driver’s license.

The Relationship Banker will collect all of the beneficiary’s personal information first to complete a beneficiary claim form.

The beneficiary claim form includes:

• Name

• Social Security Number

• Current Address

• Current telephone number

This form may need to be notarized if the beneficiary lives in a different state or country.

If there are multiple beneficiaries living in different states or countries the process of distributing account funds will take longer. The deposit account funds are not disbursed until all beneficiaries claim forms are received.

If the deposit account is a joint account, the joint account owner will remain in control of the account. Both account owners need to be deceased before the beneficiaries can claim the funds.

Does having a beneficiary on the account increase the FDIC coverage?

While naming beneficiaries for a deposit account does not directly impact FDIC insurance coverage, all deposits at One Community Bank are insured up to $250,000.

Member FDIC. Equal Housing Lender.